Minimum Deposit FXGT

Account Types and Minimum Deposits

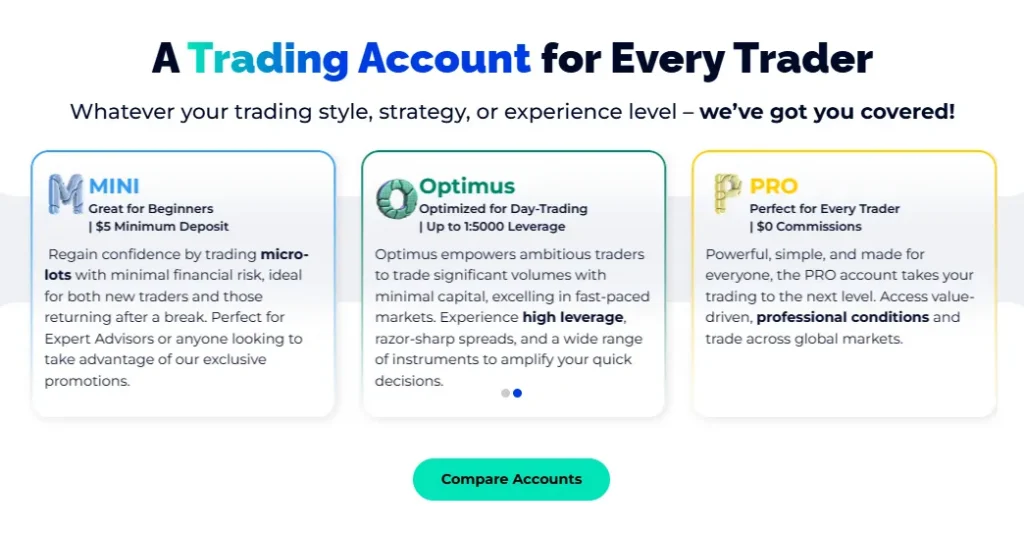

FXGT offers varied account types to accommodate different trading needs in South Africa. Each account type maintains specific minimum deposit requirements designed for different trading styles. The Standard account provides entry-level access with minimal initial investment. ECN accounts deliver institutional-grade execution for more experienced traders. Pro accounts target high-volume traders with premium conditions. Islamic accounts comply with Shariah law while maintaining competitive conditions.| Account Type | Minimum Deposit (ZAR) | Spread from | Leverage up to |

| Standard | 250 | 1.8 pips | 1:1000 |

| ECN | 1000 | 0.8 pips | 1:500 |

| Pro | 5000 | 0.1 pips | 1:200 |

| Islamic | 500 | 1.8 pips | 1:500 |

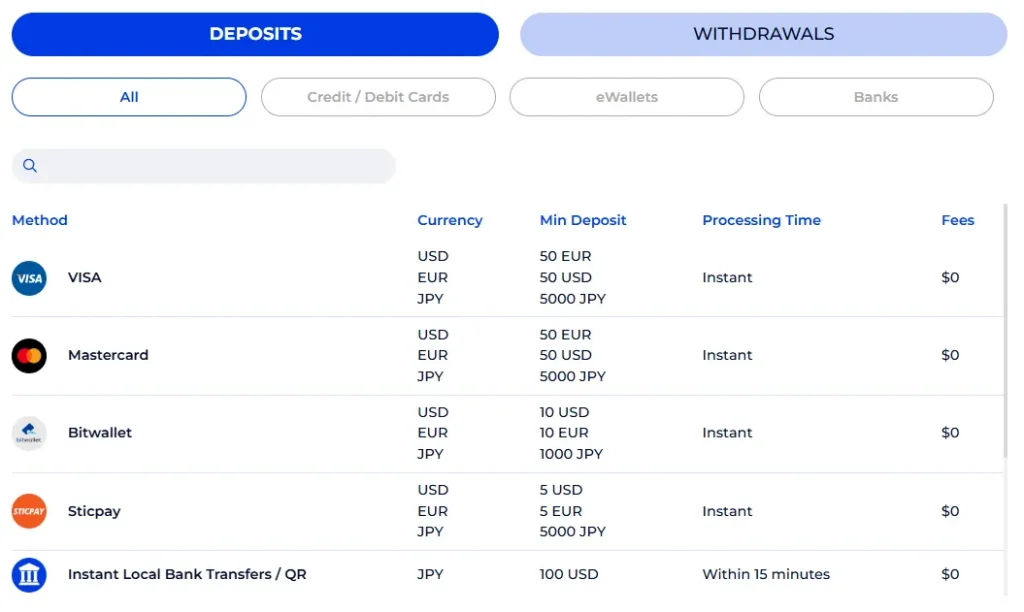

Deposit Methods

FXGT accepts multiple deposit methods for South African clients. Local bank transfers process through major South African banks. Electronic payment systems provide instant deposit options. Credit and debit card deposits process immediately. Cryptocurrency deposits convert at current market rates. Each method maintains specific minimum deposit requirements. Processing times vary by payment method. Security protocols verify all transactions. Multiple currency options remain available.

Local Payment Options

Available deposit methods include:

- Bank Transfers

- Major South African banks

- EFT payments

- Bank wire transfers

- Branch deposits

- Electronic Systems

- Credit cards

- Debit cards

- E-wallets

- Cryptocurrency

Processing Times and Fees

Bank transfer processing requires 1-3 business days. Electronic payments credit accounts instantly. Card deposits reflect immediately in trading accounts. Cryptocurrency confirmations vary by network. FXGT covers internal deposit fees. Third-party charges may apply for certain methods. Weekend processing times may extend. Currency conversion rates apply to non-ZAR deposits.

Fee Structure

Transaction fees breakdown:

- Bank transfers: Bank fees apply

- Card payments: No additional fees

- E-wallets: Provider fees may apply

- Crypto: Network fees only

Account Currency Options

Trading accounts support multiple base currencies. ZAR accounts avoid conversion fees for local deposits. USD accounts maintain international trading standards. EUR accounts serve European transactions. Currency conversion applies to non-account currency deposits. Exchange rates update in real-time. Multiple currency accounts available per client. Currency choice affects trading conditions.

Deposit Verification Process

FXGT requires verification for all deposits. Documentation needs vary by payment method. Bank transfer deposits require proof of payment. Card deposits need card verification. Large deposits undergo additional verification. Security measures protect client funds. Verification time varies by method. Support assists with verification issues.

Required Documentation

Verification requires:

- Identity Verification

- Valid government ID

- Proof of address

- Bank statement

- Card photos (if applicable)

- Transaction Proof

- Payment confirmation

- Transfer receipt

- Transaction reference

- Source of funds

Trading Conditions

Minimum deposits affect available trading features. Higher deposits access additional services. Trading volume requirements scale with deposit size. Leverage options vary by account type. Spread conditions remain consistent across deposit levels. Market execution maintains standard quality. Position sizes adjust to account balance. Risk management tools apply to all accounts.

Account Management

Client portal provides deposit management tools. Account dashboard displays transaction history. Multiple account management available. Deposit allocations control through portal. Balance transfers between accounts permitted. Account status updates in real-time. Security features protect transactions. Support assists with account issues.

Corporate Accounts

Corporate accounts require higher minimum deposits. Business verification needs additional documentation. Corporate payment methods vary from retail accounts. Account managers assist corporate clients. Multiple sub-accounts available for companies. Corporate trading conditions differ from retail. Dedicated support serves corporate accounts. Special terms apply to institutional deposits.

Platform Accessibility

Different deposit levels provide access to various trading platforms. MT4 and MT5 platforms remain available across all account types. Web trading requires no additional software installation. Mobile platforms support all account levels. Platform features scale with deposit amounts. Technical analysis tools remain accessible to all accounts. Custom indicator usage varies by platform type. Automated trading availability depends on account level.

Platform-Specific Features

Trading capabilities include:

- MetaTrader 4

- Basic charting tools

- Standard indicators

- Expert Advisors support

- Mobile accessibility

- MetaTrader 5

- Advanced charting

- Economic calendar

- Market depth view

- Enhanced timeframes

Frequently Asked Questions

Electronic payments and card deposits reflect instantly. Bank transfers typically process within 1-3 business days. Contact support if funds don’t appear after this period.

Yes, trading becomes available once the deposit reflects in your account and verification completes. Electronic payments allow immediate trading access.

Deposits below the minimum requirement return to the source account. Contact support for assistance with returned deposits. Additional fees may apply for returns.