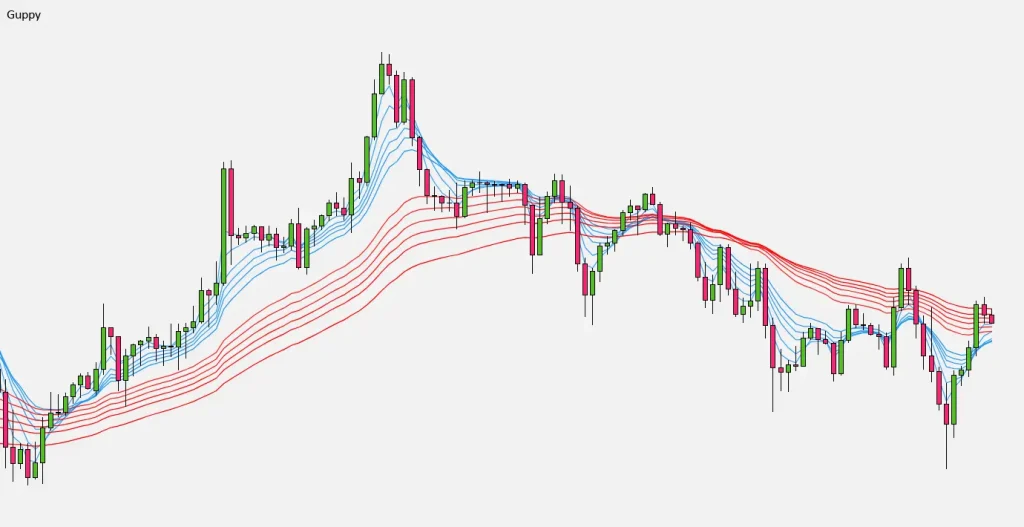

Understanding GMMA in African Markets

The South African trading environment presents unique challenges for GMMA (Guppy Multiple Moving Average) practitioners. While this technical analysis tool maintains its fundamental principles, its application requires specific adaptations for the local market dynamics of the Johannesburg Stock Exchange (JSE) and forex trading conditions.

Market Volatility Impact

The South African market experiences distinct volatility patterns influenced by:

- Currency fluctuations (ZAR)

- Commodity market movements

- Political developments

- International market correlations

- Regional economic factors

| GMMA Component | African Market Application | Risk Level |

| Short-term MA | Intraday movements | High |

| Medium-term MA | Weekly trends | Moderate |

| Long-term MA | Monthly positions | Low |

Local Market Characteristics

South African traders face unique challenges when implementing GMMA strategies due to the market’s strong correlation with commodity prices, particularly gold and platinum. This relationship creates distinctive trading patterns that require careful interpretation of GMMA signals within the context of global resource markets.Implementation Strategy for African Markets

The successful application of GMMA in South African markets requires:

- Understanding local market hours

- Monitoring international influences

- Analyzing commodity correlations

- Following JSE-specific patterns

- Implementing strict risk controls

Critical Risk Management Protocols

- Position Sizing Guidelines

- Stop-Loss Placement

- Market Exit Strategies

- Portfolio Diversification

- Risk Exposure Limits

Advanced Technical Integration

Combining GMMA with these indicators enhances trading accuracy:

- Commodity Channel Index (CCI)

- Stochastic Oscillator

- Average Directional Index (ADX)

- Volume Price Analysis (VPA)

- Moving Average Convergence Divergence (MACD)

Local Market Psychology

Understanding the psychological aspects of South African traders is crucial for GMMA implementation. The market often exhibits unique behavioral patterns influenced by:

- Local economic news

- Resource sector developments

- Currency market movements

- Regional political events

- Global market sentiment

Successful GMMA trading in South Africa requires:

- Comprehensive market analysis

- Strict risk management

- Technical indicator integration

- Regular strategy adjustment

- Continuous performance monitoring

Conclusion

Success in South African GMMA trading demands a thorough understanding of local market dynamics, proper risk management, and strategic indicator combinations. Traders must adapt their strategies to accommodate the unique characteristics of the South African financial markets while maintaining disciplined trading practices.

FAQ Section:

How does the ZAR volatility affect GMMA trading?

ZAR volatility requires traders to adjust their GMMA settings and implement wider stops to accommodate currency fluctuations.

What timeframes work best for GMMA trading in South Africa?

Daily and 4-hour charts typically provide the most reliable signals, considering local market hours and international market overlap.

How should commodity prices influence GMMA strategy?

Traders should analyze commodity price movements alongside GMMA signals, as resource prices significantly impact South African market trends.

What's the best way to manage risk with GMMA in South African markets?

Implement strict position sizing, use commodity-correlated stops, and maintain proper portfolio diversification across different sectors.

How can GMMA be optimized for JSE trading?

Adjust GMMA parameters to account for local market volatility and incorporate resource sector analysis into trading decisions.