Entering the South African Forex Market: Key Considerations

The South African forex trading landscape presents distinctive opportunities within the global financial marketplace. The Reserve Bank of South Africa’s regulatory framework has shaped a robust trading environment, making forex trading increasingly accessible to local investors. Digital transformation in financial markets has revolutionized how South Africans approach currency trading. Contemporary trading solutions combine sophisticated functionality with streamlined user experiences. The emergence of affordable trading options, including mini accounts and competitive spreads, has democratized forex trading across the nation. South Africa’s vibrant trading community expands as residents embrace financial market opportunities. A clear understanding of entry costs helps prospective traders navigate their initial steps effectively.

South African FX Trading Cost Structure

Entry-level investment requirements for South African forex traders typically range from ZAR 2000-5000. This initial capital benchmark provides new traders with sufficient flexibility to implement basic trading strategies while maintaining prudent risk management. South African forex brokers have developed diverse account structures catering to various investment capacities. Trading decisions are influenced by multiple variables, including individual financial capacity, market knowledge, and personal trading objectives. Experienced traders often emphasize the wisdom of starting modestly to build competence gradually. Consider your initial trading capital as both a financial commitment and an educational investment.

Essential Requirements for South African Traders

Regulatory Compliance

- FSCA registration verification

- Tax registration requirements

- Identity verification protocols

- Banking arrangements

- Compliance documentation

Operational Prerequisites

- Internet connectivity requirements

- Hardware specifications

- Software installations

- Security measures

- Backup systems

South African Trading Account Options

| Account Category | Minimum Entry (ZAR) | Leverage Options | Trading Benefits |

| Beginner | 2000-3000 | Up to 1:200 | Educational Support |

| Intermediate | 5000-10000 | Up to 1:400 | Advanced Tools |

| Professional | 20000+ | Up to 1:500 | VIP Services |

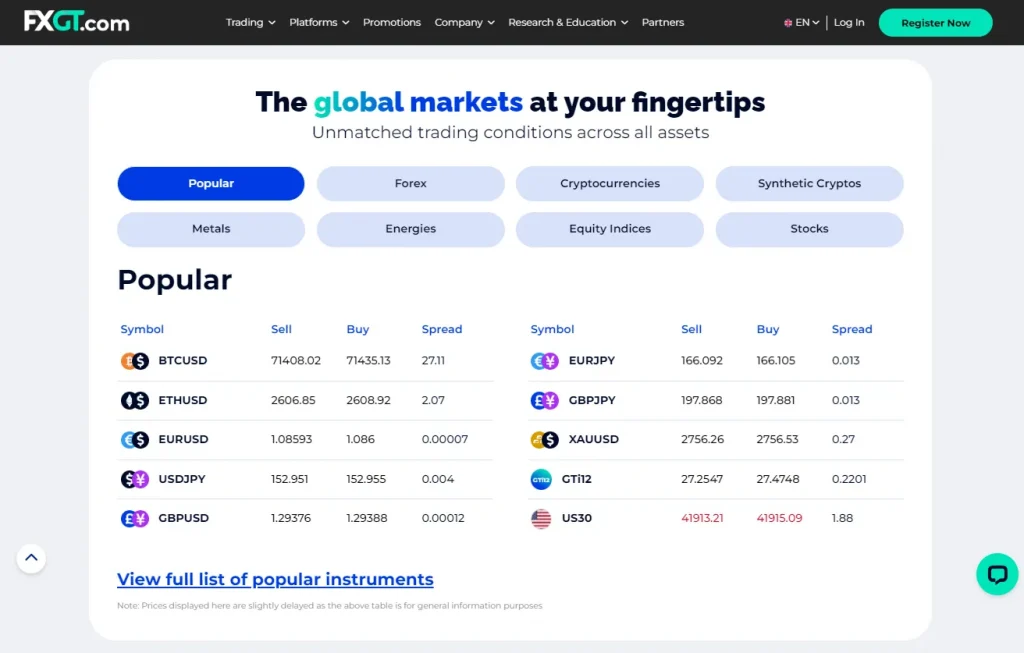

Maximizing South African Broker Offerings

South African forex brokers compete through innovative incentive structures designed to attract traders. These include deposit multipliers, trading credits, and educational resources. Every promotional offer carries specific trading conditions requiring thorough evaluation. Strategic utilization of broker incentives can significantly enhance trading potential. Successful traders frequently leverage multiple promotional benefits to optimize their trading experience. Understanding the nuances of broker offerings facilitates informed decision-making.

Strategic Trading Elements

Capital Preservation Techniques

- Risk percentage allocation

- Drawdown management

- Portfolio diversification

- Emergency fund maintenance

- Recovery strategies

Performance Metrics

- Success rate targets

- Investment return goals

- Risk assessment criteria

- Trading frequency limits

- Position duration guidelines

Cost Management Strategies Table

| Strategy | Cost Benefit | Risk Profile |

| Cent accounts | Minimal exposure | Conservative |

| Virtual trading | Risk-free practice | None |

| Bonus leverage | Capital enhancement | Moderate |

Professional Trading Insights

Operating with limited capital demands exceptional understanding of margin requirements and leverage implications. South African traders must prioritize developing comprehensive risk management frameworks while utilizing available market resources. Success potential exists across market conditions, but methodical approach remains crucial. Industry veterans advocate for conservative position sizing during the learning phase. Capital preservation becomes paramount when trading with modest accounts. Market analysis skills directly impact trading outcomes.

Growth Acceleration Strategies

Knowledge Enhancement

- Professional certifications

- Market research tools

- Trading networks

- Strategy workshops

- Expert mentorship

Performance Optimization Tools

- Trade analyzers

- Risk management software

- Performance tracking

- Market indicators

- Automation tools

FAQ

What's the bare minimum to start forex trading in South Africa?

While some platforms accept deposits from ZAR 1000, a recommended starting capital is ZAR 2000-5000 for effective trading.

Are there ways to start trading without initial capital?

While some brokers offer no-deposit promotions, sustainable trading typically requires personal capital investment.

How does leverage work under South African regulations?

South African brokers offer leverage up to 1:500, but higher leverage increases both potential returns and risks proportionally.

What ongoing costs should South African traders consider?

Regular expenses include dealing spreads, overnight funding rates, and potential account maintenance fees.

Item #5

Profitability timeline varies based on strategy efficiency, market conditions, and risk management, typically requiring 6-12 months of consistent trading.