The South African forex market presents unique opportunities and challenges for traders using technical analysis. While many focus on basic chart patterns, successful trading in the ZAR-influenced market requires a deeper understanding of local economic factors, timing considerations, and market psychology. This guide explores comprehensive approaches to pattern trading specifically tailored for South African market conditions.

Pattern Trading Fundamentals in South African Markets

Market-Specific Considerations:

- ZAR volatility impact

- Local trading session dynamics

- Cross-border capital flow effects

- Regional economic influences

- Commodity price correlations

| Component | Strategic Value | Implementation Method |

| Volatility bands | Risk assessment | Real-time adaption |

| Price momentum | Entry timing | Multiple indicator confluence |

| Market depth | Pattern strength | Order flow analysis |

| Time correlation | Session impact | Cross-market verification |

Strategic Implementation Framework

Building a robust trading approach in South African markets requires:

Technical Framework Integration:

- Volatility-adjusted pattern identification

- ZAR-specific support/resistance levels

- Regional session overlap analysis

- Commodity correlation tracking

- Cross-pair pattern validation

Entry Optimization Methods:

- Local market opening procedures

- International market impact assessment

- News-adjusted timing strategies

- Volume profile analysis

- Risk parameter customization

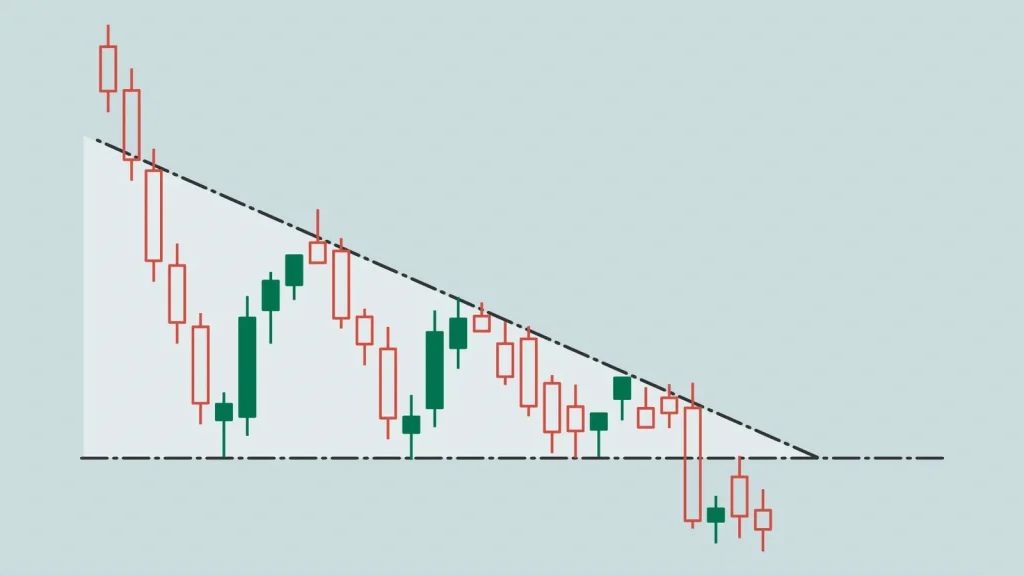

High-Probability Patterns for South African Trading

Table 2: Pattern Performance Matrix| Pattern Type | ZAR Success Rate | Optimal Trading Window |

| Harmonics | 85% | London-SA overlap |

| Wedge Formations | 82% | SA morning session |

| Channel Breaks | 79% | US-SA crossover |

| Complex Pullbacks | 77% | Asian transition |

Risk Management in ZAR Trading

Local Market Risk Controls:

- Currency-specific position sizing

- Volatility-based stop placement

- Session-dependent risk adjustments

- Cross-border exposure limits

- Drawdown management protocols

Market Condition Assessment:

- Local economic indicators

- Regional political factors

- Global commodity trends

- Capital flow monitoring

- Currency correlation analysis

Advanced Pattern Recognition Framework

Pattern Qualification Process:

- Market structure alignment

- Volume distribution analysis

- Time-based confirmation

- Multi-timeframe validation

- Price action context

Trading Psychology Adaptation:

- High-volatility mindset

- Local market patience

- Global perspective maintenance

- Risk tolerance calibration

- Performance tracking methods

FAQ

How does ZAR volatility affect pattern trading?

South African market volatility requires wider stops, careful position sizing, and stronger confirmation signals compared to major currency pairs.

Which sessions are most reliable for ZAR pattern trading?

The London-South African overlap typically offers the best combination of liquidity and price action clarity for pattern trading.

How should commodity prices influence pattern trading decisions?

Gold and platinum price movements often precede ZAR patterns, making commodity trend analysis essential for confirmation.

What's the recommended starting capital for pattern trading in SA markets?

Given ZAR volatility, a minimum of R50,000 is recommended to properly implement risk management strategies.

How can local traders optimize their pattern trading approach?

Focus on patterns that align with major SA trading sessions, incorporate commodity correlations, and maintain strict risk controls based on ZAR volatility.