Understanding Candlestick Patterns in African Markets

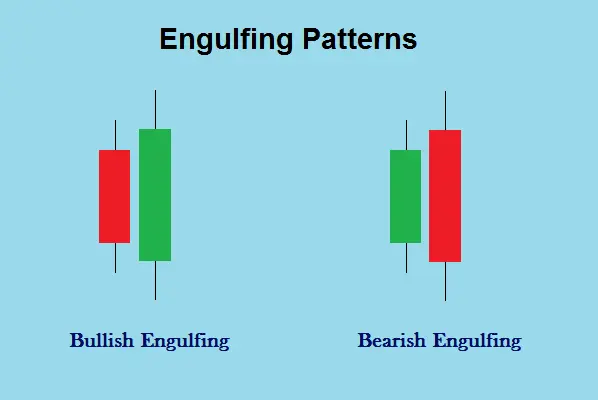

The South African forex market presents unique opportunities for traders utilizing Japanese candlestick patterns, particularly the Engulfing Pattern. With the ZAR being one of Africa’s most traded currencies, understanding these patterns becomes crucial for local market participants.

Essential market characteristics in South Africa:

- High liquidity during European crossover

- ZAR volatility influences

- Commodity price correlation

- International trade impact

- Regional economic factors

The South African Reserve Bank’s monetary policies significantly influence currency movements, making pattern recognition even more valuable for local traders.

Pattern Recognition in ZAR Trading

Market Phase | Pattern Significance | Trading Volume Impact |

Pre-London | Pattern Formation | Moderate Activity |

London-SA Overlap | Highest Reliability | Peak Volume |

US Session | Confirmation Phase | Strong Movement |

Understanding local market dynamics enhances the effectiveness of engulfing pattern identification, particularly when trading ZAR pairs against major currencies.

Technical Implementation for South African Traders

Critical success elements:

- Market timing considerations

- ZAR correlation analysis

- Commodity price monitoring

- Global market impact

- Local economic indicators

The Engulfing Pattern (包み足 手法) strategy requires adaptation to South African market conditions, particularly during times of high ZAR volatility.

Risk Assessment Framework

Risk Element | Control Measure | Local Market Application |

Currency Risk | Hedge Positions | ZAR Pair Protection |

Market Gap Risk | Position Limits | Weekend Coverage |

Volatility Risk | Dynamic Stops | News Adjustment |

Advanced Pattern Analysis

South African market indicators:

- Commodity price movements

- Mining sector influence

- Political stability factors

- International trade data

- Regional economic metrics

Pattern validation requires careful consideration of local market conditions and global influences affecting the ZAR.

Trading Strategy Development

Essential components for success:

Local Market Analysis

- ZAR pair behavior

- Commodity correlations

- Regional economic factors

- Political impact assessment

- Global market influence

Position Management

- Risk calculation methods

- Position sizing rules

- Stop-loss adaptation

- Profit target setting

- Trade monitoring procedures

Market Timing

- Session overlap analysis

- Volatility assessment

- News impact evaluation

- Pattern confirmation

- Entry timing optimization

Market Context Understanding

| Time Period | Trading Conditions | Pattern Reliability |

| SA Morning | Local Market Impact | Medium |

| European Overlap | Highest Activity | Very High |

| US Session | Global Influence | High |

Implementation Guidelines

Critical success factors:

- Pattern recognition accuracy

- Local market knowledge

- Risk management discipline

- Technical analysis skills

- Psychological preparation

The South African forex environment requires traders to adapt their strategies to local market conditions while maintaining global awareness.

Conclusion

Trading the Engulfing Pattern in South Africa requires a unique approach that considers local market dynamics and global influences. Success depends on combining technical analysis with an understanding of ZAR-specific factors and proper risk management.

FAQ Section

How does ZAR volatility affect engulfing pattern trading?

Higher ZAR volatility requires wider stops and careful position sizing, but can also create more trading opportunities.

What are the best times to trade engulfing patterns in South Africa?

The London-SA market overlap (10:00-12:00 SAST) typically offers the most reliable trading conditions.

How should commodity prices influence pattern trading decisions?

Monitor gold and platinum prices closely as they often correlate with ZAR movement and pattern reliability.

What risk management adjustments are needed for ZAR pairs?

Use wider stops due to higher volatility and limit position sizes to 1% of capital per trade.

How can South African traders validate engulfing patterns?

Combine pattern analysis with local market indicators, commodity prices, and global market sentiment.