Mastering Market Analysis: The South African Wyckoff Approach

The Wyckoff Method’s application in South African markets represents a sophisticated approach to trading that combines classical principles with local market dynamics. This methodology has gained significant traction among professional traders in the region, particularly due to its effectiveness in analyzing the unique characteristics of African financial markets.

Core Trading Elements:

- Market Structure Analysis

- Volume-Price Relationships

- Trend Identification

- Cycle Recognition

- Position Management

- Risk Assessment

- Entry Timing

- Exit Strategy Development

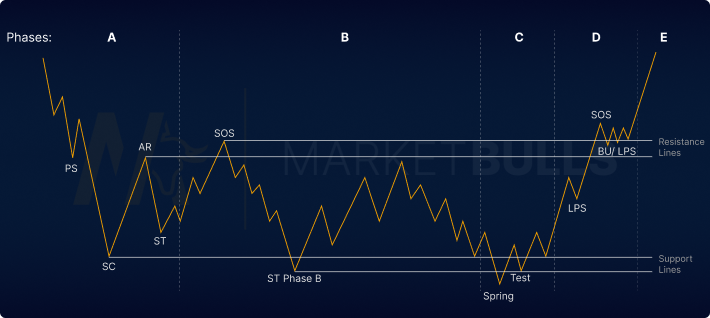

Market Phase Analysis and Implementation Table:

| Phase | Market Characteristics | Trading Strategy | Risk Profile | Volume Patterns |

| Initial Accumulation | Low volatility, base formation | Position building | Conservative | Increasing gradually |

| Active Accumulation | Rising support levels | Strategic scaling | Moderate | Strong buying volume |

| Mark-Up Phase | Trend establishment | Position optimization | Balanced | Consistent strength |

| Early Distribution | Resistance testing | Profit taking | Elevated | Distribution signs |

| Late Distribution | Trend weakness | Position reduction | High | Selling pressure |

| Markdown Phase | Downward momentum | Short opportunities | Maximum | Climactic volume |

Understanding Local Market Context:

The South African trading environment presents unique characteristics that affect Wyckoff analysis:

- Resource market influence

• Currency volatility impact

• Global market correlation

• Local economic factors

• Political risk considerations

Advanced Implementation Framework

Technical Analysis Integration

- Support/Resistance identification

- Trend channel analysis

- Volume pattern recognition

- Momentum assessment

- Time frame correlation

Strategic Position Management Table:

| Strategy Component | Implementation Method | Risk Control | Performance Metrics |

| Entry Planning | Phase-based positioning | Stop placement | Risk-reward ratio |

| Position Building | Systematic scaling | Exposure limits | Portfolio balance |

| Risk Management | Dynamic adjustment | Position sizing | Maximum drawdown |

| Exit Strategy | Target achievement | Profit protection | Overall returns |

Market Psychology Understanding:

Successful trading in South African markets requires:

- Emotional Control

- Strategic Patience

- Risk Awareness

- Market Knowledge

- Professional Discipline

- Analytical Skills

Advanced Trading Considerations:

Local Market Factors | Global Influences | Technical Aspects |

Economic indicators | Commodity prices | Chart patterns |

Political events | Currency markets | Volume analysis |

Sector rotation | International flows | Trend strength |

Market liquidity | Global sentiment | Technical indicators |

Implementation Guidelines:

Market Analysis Process

- Phase identification

- Volume study

- Price action analysis

- Trend confirmation

- Entry point selection

Risk Management Framework:

• Position sizing rules

• Stop-loss placement

• Profit target setting

• Portfolio allocation

• Risk exposure limits

Advanced Technical Integration:

- Chart Analysis Techniques

- Volume Pattern Recognition

- Trend Line Drawing

- Support/Resistance Mapping

- Time Frame Correlation

- Momentum Assessment

| Key Components | Implementation | Measurement |

| Emotional Control | Systematic approach | Performance tracking |

| Strategy Adherence | Rule-based trading | Consistency metrics |

| Risk Management | Position control | Drawdown analysis |

| Market Understanding | Continuous learning | Knowledge assessment |

- Understanding JSE dynamics

- Resource sector analysis

- Currency correlation study

- Economic impact assessment

- Political risk evaluation

- Sector rotation tracking

Conclusion:

The Wyckoff Method, when properly adapted to South African market conditions, provides traders with a comprehensive framework for market analysis and trading success. Success requires a deep understanding of both the methodology and local market dynamics, combined with disciplined execution and proper risk management.FAQ

How does South African market volatility affect Wyckoff analysis?

Higher volatility requires stricter risk management and careful phase identification within the Wyckoff framework.

What role do commodities play in South African Wyckoff trading?

Commodity prices significantly influence market movements, making them crucial for accurate Wyckoff analysis.

How should traders adapt to local market conditions?

Traders should consider local economic factors, political events, and currency movements while maintaining Wyckoff principles.

What are the most important volume patterns in South African markets?

Accumulation and distribution patterns are particularly important, especially in relation to resource sector movements.

How can beginners start applying Wyckoff methods in South African markets?

Begin with studying market phases, practice identifying patterns on historical data, and start with small positions while learning.